Clash of the Financial Titans: An In-Depth RRG Comparison Between Large Cap and Small Cap

Title: The Large Cap vs. Small Cap Debate – A Comprehensive RRG Comparison

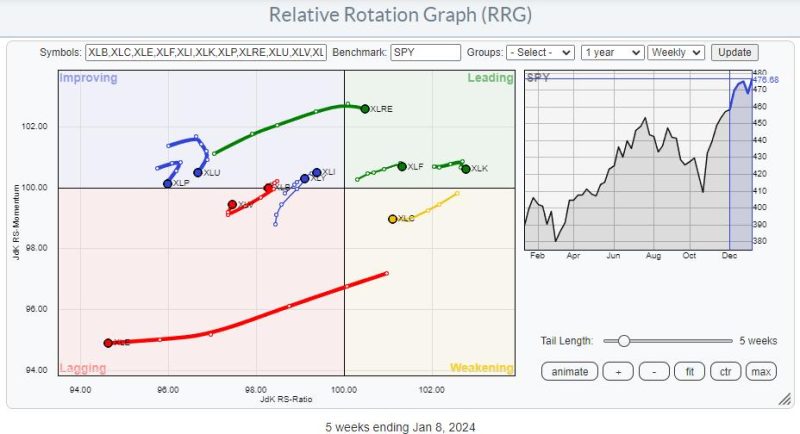

In the world of financial trading and investments, understanding the distinction between Large Cap and Small Cap stocks becomes essential. This article elucidates this debate using the Relative Rotation Graph (RRG), a formidable tool in comparative market analysis.

The Relative Rotation Graph delineates the relative strengths and weaknesses of a group of stocks or market sectors. The technical tool uses a scatter plot to present the relative behavior of these entities in a unique, rotational manner. For the uninformed, ‘Cap’ refers to the market capitalization of publicly traded companies, with ‘Large Cap’ and ‘Small Cap’ reflecting companies with a larger and smaller market capitalization, respectively.

In the Large Cap vs. Small Cap debate, several factors contribute to their unique advantages and disadvantages.

Large Cap companies are often characterized by their stability and established track record. These companies are typically national or global market leaders, offering higher liquidity and predictable revenue streams. Investors who favor predictability and lower risk often lean towards Large Cap stocks. They are also more likely to pay dividends, providing a steady, albeit potentially smaller, return on investment.

On the other hand, Small Cap companies offer an entirely different set of benefits. These companies typically have higher growth potential than Large Cap companies. Given their relative obscurity, they often fly under the radar of large institutional investors, providing considerable opportunity for individual investors. However, these stocks carry a higher level of risk and volatility.

Now, let’s dive into the heart of the comparison using RRG. According to the report on GodzillaNewz, there is an observable shift in favor of Large Cap stocks over Small Cap ones. It’s essential to note that this trend is a normalized metric of performance and does not indicate absolute gains or losses.

In the RRG, Large Cap sectors are migrating towards the leading quadrant, indicating their increasing relative performance against the benchmark. The Small Cap sectors, conversely, are moving towards the lagging quadrant, reflecting their dwindling performance against the same benchmark.

It is important to clarify that these trends may change based on economic and market conditions. These lockdown shifts indicate market sentiment and trends but do not guarantee future performance. Hence, diversified portfolios that include both Large Cap and Small Cap stocks could potentially offer an optimal blend of stability and growth potential.

The Large Cap vs. Small Cap debate, seen through the lens of the RRG study, uncovers fascinating insights into market trends. While