Non-Mega Cap Tech Stocks On The Rise: Insights from RRG!

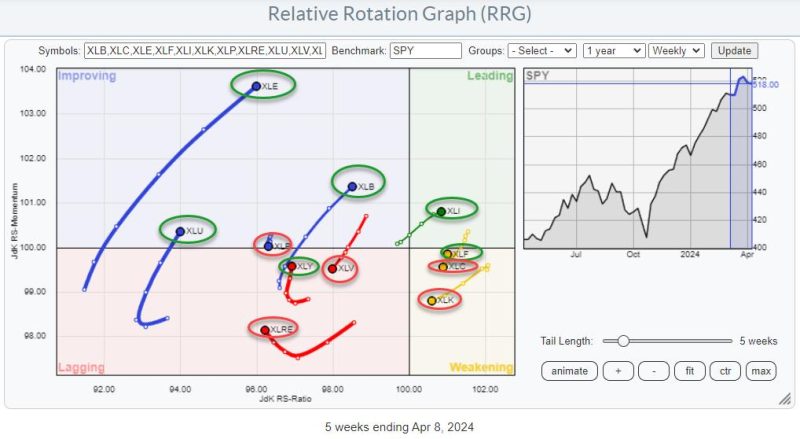

Understanding the current financial market trends is crucial for investment decisions. One of such developments is the Relative Rotation Graph (RRG) pointing out the enhancement of non-mega cap technology stocks. The RRG technique, established by Julius de Kempenaer, presents a deep view into the complex dynamics of the financial markets by identifying the relative strength of different stocks. It is a dynamic tool that utilizes the concept of rotation to show the changing momentum of various stocks in relation to one another. Notably, it’s now indicating an upward trend for non-mega cap technology stocks, indicating substantial potential opportunities for investors.

Non-mega cap technology stocks refer to the shares of technology companies that fall outside of the mega capitalization zone, which typically possess a market capitalization of less than $200 billion. Despite being relatively smaller in size, these technology stocks are now finding renewed momentum according to the indications of the RRG.

Previously, mega-cap technology stocks dominated the market, with companies such as Amazon, Apple, Facebook, and Google’s parent company, Alphabet. These companies not only sustained their importance in the market but also displayed resilient performance throughout different economic climates thanks to their strong financials and influential market positions. However, as per recent RRG indications, non-mega cap tech stocks are exhibiting significant improvements in strength.

One of the primary reasons for this trend is the recent tech industry growth beyond the traditional mega-cap organizations. Various smaller technology companies, particularly those focused on software, cybersecurity, and cloud-based services, are rising quickly. As business models across industries steer towards more digital and online operations, the demand for these services is skyrocketing, leading to increased profitability margins for the non-mega cap tech stocks.

The RRG is also indicating that non-mega cap tech stocks are advancing towards the leading quadrant. Once a stock lands in the leading quadrant, it symbolizes outperformance compared to other stocks, suggesting that these are becoming lucrative options for the investors. Non-mega cap tech stocks are taking full advantage of this changing marketplace by providing innovative solutions fitting for this current digitalized world climate.

It’s important not to forget that since the onset of the global pandemic, the technology sector, as a whole, has ascended to new heights. This surge in popularity and demand has facilitated these smaller non-mega cap tech companies to move into the limelight and experience growth. Combined with the evolving market needs, these trends have shifted momentum from traditional mega-cap tech stocks to non-mega cap tech stocks