Mastering the Market: Unveiling Secrets of Rule-Based Money Management – Part 2

Part 1 of this series explored the essential components of rules-based money management, underlining the need for a disciplined and objective approach to investing. As we continue our journey into this crucial aspect of successful investing, we now delve into the heart of sound decision-making: measuring the market.

Understanding Market Evaluation

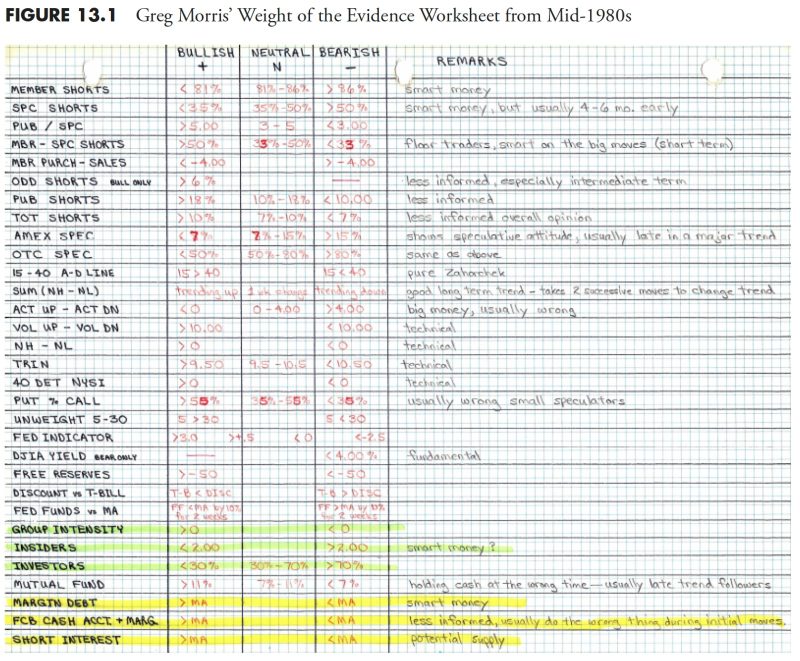

In the domain of rules-based money management, measuring the market is not merely about assessing price trends; it is about a comprehensive evaluation of market conditions. This systematic evaluation gives a holistic understanding of the market environment and, more critically, provides a basis for sound investment decisions.

Market measurement involves looking at several aspects, such as price trends, volatility, market sentiment, economic indicators, and monetary conditions. Analyzing these factors offers investors the information they need to evaluate the market’s overall ‘health.’

Understanding Price Trends

Price trends are crucial elements in market measurement. An evaluation of price trends can potentially provide investors with information about the market’s future direction. This information can enhance portfolio performance through well-informed buying and selling decisions based on potential future market movements.

Traders use various statistical techniques like moving averages, trend lines, and more sophisticated methods like machine-learning algorithms to identify and predict price trends. These tools help investors make informed decisions about when to buy, hold, or sell assets. Moreover, investors who continually monitor price trends can adapt their strategies based on the market’s prevailing conditions, thus ensuring better risk management.

Concept of Volatility

Volatility is another vital component of market measurement. It represents the degree of variation of a financial instrument’s trading price. High volatility typically means that the price of an asset can change dramatically over a short time in either direction. In contrast, low volatility indicates that a security’s value does not fluctuate significantly and moves at a steadier pace.

Investors use volatility as a gauge to assess the risk and uncertainty associated with a particular investment. If an investment exhibits high volatility, investors perceive it as risky since its price can change rapidly in a very short time. On the other hand, investments with low volatility are viewed as less risky, as their prices do not fluctify dramatically.

Market Sentiment, Economic Indicators, and Monetary Conditions

Market sentiment can significantly influence investment decisions. It refers to the overall attitude of investors toward a particular security or financial market. It is a general feeling or tone of the market, or its mood.

Economic indicators, such as inflation, GDP, and unemployment rates, are also essential tools for evaluating