Caution! Stocks Set for a 10% Dip as Value Emerges as Leader

Body:

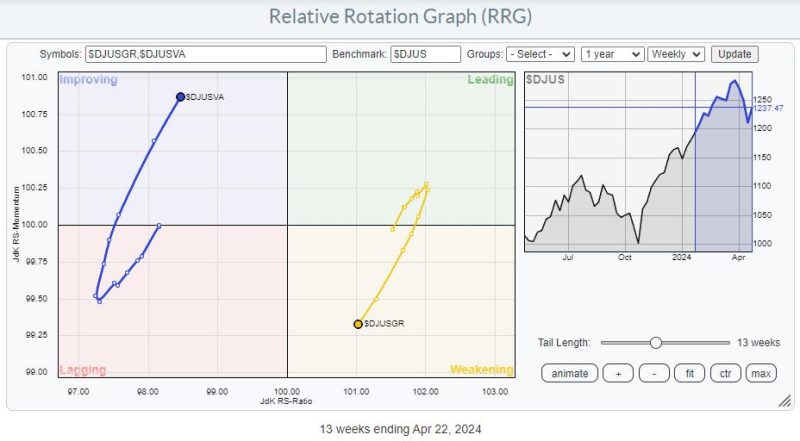

In recent times, the financial markets have witnessed a shift towards value stocks. As is often the case, this change in direction isn’t without its repercussions. With the tilt towards value, the stock market may potentially be impacted by a 10% downside risk. Let’s unpack the intricacies of this delicate balance between risk and reward.

To begin with, value stocks are those shares that trade for less than their intrinsic values. Usually emerging from industries under financial scrutiny or sectors going through recessionary periods, their lower-than-deserved prices tag them as value stocks. For investors, this can make them an attractive proposition, given their capacity to provide significant returns as the companies regain their footing.

However, the current case paints a different picture. The upswing in value stocks has precipitated a shift in investor sentiment, with most getting wary of a potential downside risk. This downside risk reflects the potential for the market to regress, which in this case might be as much as 10%.

Several indicators are pointing to this potential shift. A key harbinger lies in higher bond yields. The rise in bond yields is generally an accurate predictor of a shift towards value stocks as it indicates a rise in interest rates. This rise puts pressure on the higher growth part of the stock market, which in turn, makes value stocks more attractive.

Another contributing factor pertains to inflation. As inflation levels increase, companies that have high-profit margins or those with the capacity to increase prices tend to attract investment. These types of companies are generally deemed as value stocks. However, this sentiment amplifies the potential downside risk because many growth companies exhibit lower margins and less pricing power, factors that can broadly impact the stock market.

In addition to this, higher commodity prices in industries like steel, oil and copper are prompting a shift towards value stocks. These industries generally house value stocks and a rise in commodity prices tends to boost their prospects, further driving this shift.

Finally, an upcoming expected policy tightening by the Federal Reserve is another piece of the puzzle. Higher interest rates by the central bank would challenge growth stocks while favoring value stocks, considering that value companies are usually more restrained toward leveraging than their growth counterparts and as such, are less sensitive to changes in interest rates.

The convergence of these circumstances has led market strategists to predict a 10% downside for the stock market. However, for savvy investors who can navigate these shifting dynamics, there could still be room for significant gains. It is therefore essential to stay abre