Mastering the Market: Defining Trends & Managing Trades with the ATR Trailing Stop

In any trading strategy, managing the trade and defining the trend are two key components to achieving sustainability in profits. For these purposes, traders often leverage a versatile indicator like the Average True Range (ATR) Trailing Stop. This tool aids in assessing market volatility and setting stop orders that can minimize losses and capture profits optimally.

The Basics of ATR Trailing Stop

The Average True Range (ATR) Trailing Stop is an indicator that’s utilized to determine stop loss levels. It’s based on the Average True Range (ATR), which measures market volatility by calculating the average range between the highest and lowest prices of a financial instrument over a specified period. The ATR Trailing Stop strategy applies this volatility data to define the stop loss level, trailing the price movements to secure profits or minimize losses.

Using the ATR Trailing Stop to Manage Trade

Managing trades involves making decisions about when to enter or exit a trade, essentially defining the levels of potential profit or loss. With ATR Trailing Stop, a stop loss level will keep moving or trailing depending upon market fluctuations and their volatility. This represents an automatic mechanism that helps you lock in profits when the trend is in your favor and limit losses when the market reverses.

If the ATR Trailing Stop level is above the current price in a downward trending market, it signals a sell. Here, the stop loss level remains fixed until the price surpasses the ATR Trailing Stop level from below. On the other hand, if the stop level is below the current price in an upward trending market, it indicates a buy. In this case, the stop level remains the same until the price crosses the ATR Trailing Stop level from above.

Using the ATR Trailing Stop to Define the Trend

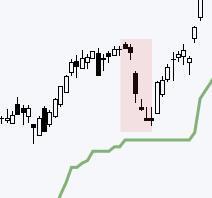

The ATR Trailing Stop is also an excellent tool to define or identify market trends. It portrays the directional bias of the trend visually, enabling you to comprehend better whether the trend is bullish or bearish. When the ATR Trailing Stop is above the price, it paints a line in red, indicating a bearish or downward trend. Conversely, if the ATR Trailing Stop is situated below the price, the line turns green, signaling a bullish or upward trend.

Furthermore, the ATR Trailing Stop functions efficiently in both choppy and trending markets. It efficiently identifies market reversal points, providing insightful data for traders to consider before placing their trade. A change in the ATR