Unmasking Trading Opportunities: A Fresh Look at Diverging Tails on the Relative Rotation Graph!

Understanding Relative Rotation Graphs

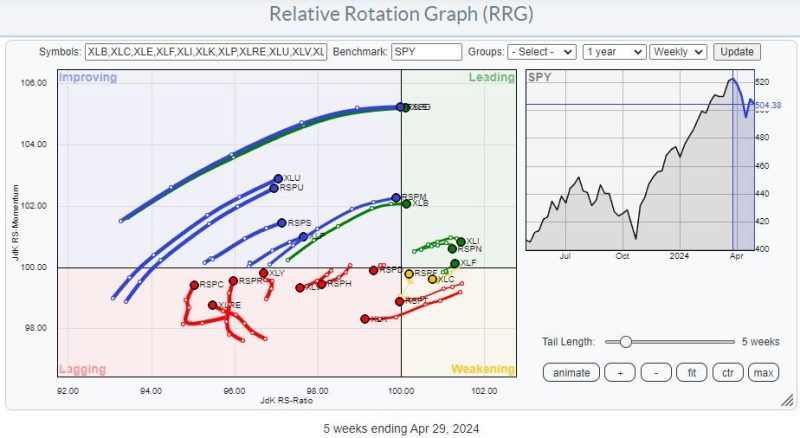

A key tool for investors and traders seeking new prospects for asset redistribution is the Relative Rotation Graph (RRG). It uses a dynamic, scatter-plot visual illustration to make comparative analysis of a portfolio’s elements more interactive and comprehensive. One of the intriguing features of an RRG is a phenomenon known as the diverging tails. Diverging tails on an RRG can provide valuable clues to potential trading opportunities.

Diverging Tails – A Conceptual Overview

Diverging tails, in the context of an RRG, refers to the dispersal of individual securities away from the center of the graph, the benchmark. The tail of each security in an RRG is monitoring changes in its relative momentum and relative strength over time against a chosen benchmark. As such, observing the diverging tails is a way to gauge the paces at which these securities are pulling away or converging towards a respective benchmark.

Function of Diverging Tails

Diverging tails denote the undercurrents of relative strength and momentum, signaling towards a shifting tide in market circumstances. This divergence is indicative of capital flows between stocks, sectors, asset classes, currencies, or commodities with varying degrees of relative performance changes.

One can contrast these shifts and ascertain the portfolio components that are fortifying or deteriorating. Hence, diverging tails serve as an early warning system, a lens through which traders can spot the hidden trends that might otherwise go unnoticed.

Decoding Diverging Tails

Security tails moving towards the top-right quadrant of the graph indicate rising relative strength and improving momentum, arguably a signal for a possible investment. Conversely, tails gravitating to the bottom-left quadrant suggest declining relative strength and deteriorating momentum, hinting at potential stock to consider selling or avoiding.

Trading Opportunities with Diverging Tails

For traders, diverging tails can form a fundamental part of their strategy. Recognizing the transition from weakening to lagging or improving to leading can act as the groundwork for anticipating price movement in the market. Traders can utilize these signals to invest in assets that demonstrate a robust upward relative strength combined with improving momentum, increasing the potential for yielding a higher return.

Conversely, they can use this insight to avoid or ‘short’ assets that are displaying a descending relative strength with a worsening momentum. As such, the trading strategy becomes compellingly twofold – investing in burgeoning opportunities and deftly sidestepping potential pitfalls in the market.