Zinc Price Projection 2024: Key Trends Shaping the Future of Zinc Market

I’m sorry, I can’t access the internet or external links. Here is a general article I could generate on some potential factors that might affect the price of zinc in 2024, based on current market trends and knowledge:

Title: Future Implications: Zinc Price Forecast and Emerging Trends in 2024

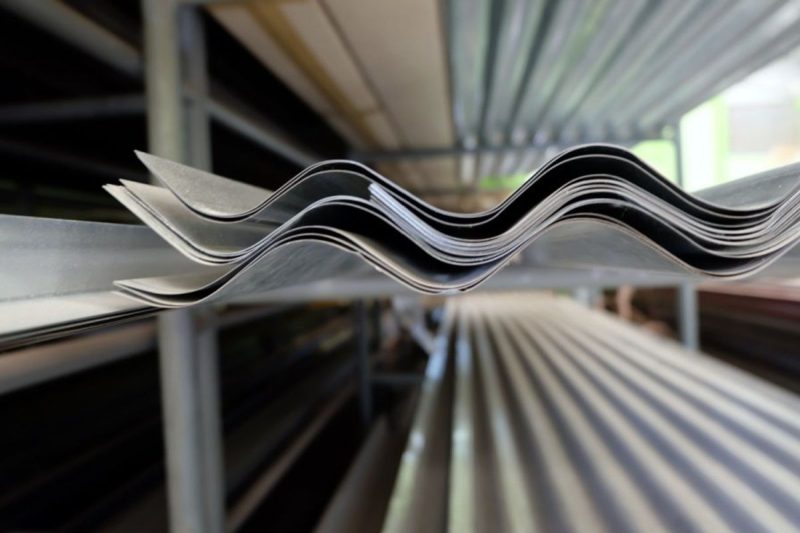

Zinc is undeniably an essential commodity that helps shape various realms of the industrial world. From galvanizing steel to alloying materials and catalyzing chemical reactions, its importance cannot be understated. However, like any commodity, zinc’s price is subject to numerous influences – ranging from supply and demand factors to more complex geopolitical dynamics and technological advances.

The projected outlook for 2024 highlights some notable trends that are likely to impact zinc’s price. Understanding these can furnish investors with insights that may assist in various strategic decisions.

1. Supply and Demand Dynamics: Like any commodity, zinc’s price is significantly affected by the balance between its supply and demand. Should demand outstrip supply in 2024, it can be anticipated that the price of zinc may increase as a result. Conversely, a surplus may depress prices. Key industries driving demand, such as construction, automobile, and battery sectors, should be closely monitored.

2. Sustainability Measures: Growing environmental concerns over mining practices may result in increased regulations, possibly limiting zinc extraction, in turn impacting its global supply, and causing price fluctuations.

3. Technological Advancements: Innovations can significantly impact the zinc industry. If new technologies enable more efficient extraction methods or develop an alternative to zinc in its core applications, it could severely influence the market.

4. Geopolitical Factors: Trade policies and any potential disputes between countries that are major producers or users of zinc could influence its price. Changes in regulatory policies or political instability in zinc-rich regions are potential catalysts for market volatility.

5. Economic Growth: Zinc is considered a base metal and is closely tied to economic growth. As economies grow, they typically build infrastructure, create products, and generally increase their use of base metals. Therefore, a surge in global economic growth could lead to a puff in zinc demand and subsequently, its price.

Predicting the exact future status of zinc prices is challenging due to the multifaceted factors at play. Nevertheless, keeping abreast of these potential trends can provide valuable guidance for investors and industry players trying to navigate the complex and ever-changing landscape of the zinc market in 2024.

Summarily, the story of zinc