“Maximizing Investment Returns with the McClellan Oscillator!

The McClellan Oscillator is an important tool used to gauge the strength or weakness of specific financial markets, such as the investment-grade bond market. Trending data is collected and collated to identify any potential reversals or shifts in fortunes. This can be used to benefit professional and retail investors, allowing them to make informed decisions regarding the purchase and sale of bonds on the market.

The McClellan Oscillator is a technical indicator named after Sherman McClellan, the trading systems analyst who developed it in the late 1970s. It is typically used to identify potential purchase or sell points by highlighting overbought and oversold signals. The Oscillator itself is a summation of even data from two Exponential Moving Averages (EMAs), forming the basis of an 80-day data reading.

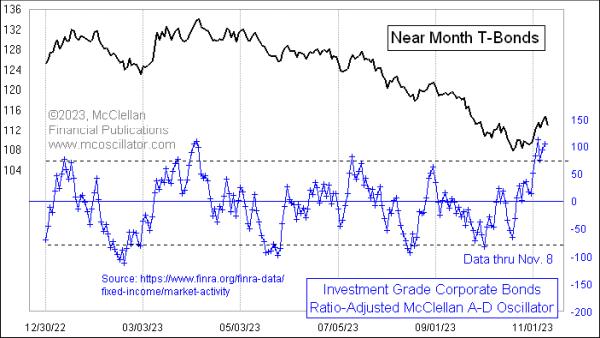

The McClellan Oscillator works by measuring the spread between two EMAs of different lengths as opposed to a 52-week high or low. Essentially, the difference between the two EMAs will indicate if a trend is strong of weak. In recognition of this, the Oscillator creates numerical readings in the form of a histogram that will provide an understanding of whether the trend in the investment-grade bond market is positive or negative.

The McClellan Oscillator is viewed as an important tool for investors interested in the stock market as well as those making decisions regarding the investment-grade bond market. It provides crucial insight related to potential reversals or shifts within the market with the goal of profiting from changes in prices. It also allows investors to eliminate some of the risks associated with investing in these instruments, as the Oscillator with its numerical data can be used to identify areas of strength or opportune points to enter or exit positions.