Mastering Your Finances: The Power of Relative Strength in Rules-Based Money Management – Part 3

In the previous parts of this article, we delved into the concept of rules-based money management and its importance in personal finance or investment. Now, we advance to part three, where we will explore relatively less-mentioned aspects – ‘Relative Strength’ and ‘Other Measures’.

## Unraveling Relative Strength

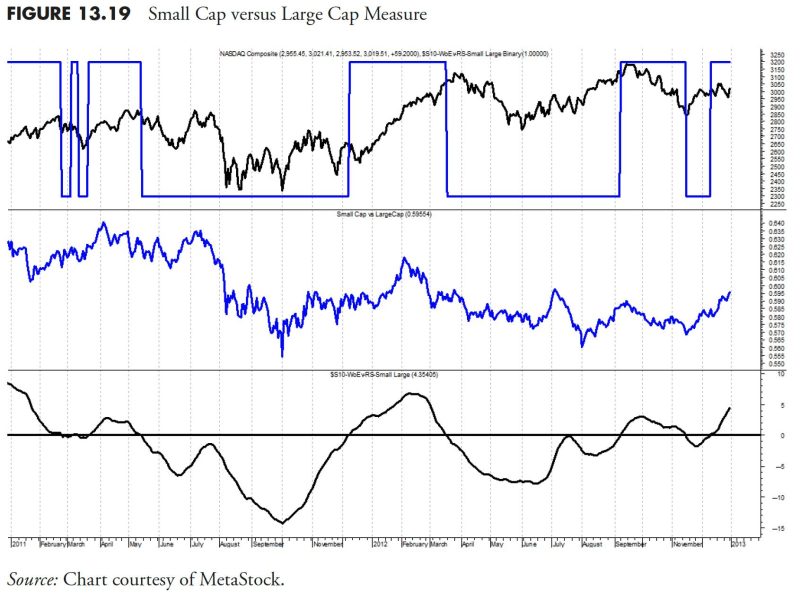

Not to be mistaken with a similar term in physics, ‘Relative Strength’ in finance is a measure of the price performance of a certain security or investment, compared to a specific market index or another investment. It is an investment strategy that helps you to track the past performance of your investment. By comparing your security’s performance against a benchmark, you can gain insights about its effectiveness and, in the long run, make information-driven investment decisions.

Calculating relative strength isn’t very complex; you simply divide the price of a security by the price of the chosen benchmark. A rising quotient implies that your security is outperforming the market or the benchmark, whilst a dropping quotient suggests underperformance.

Using relative strength as part of your rules-based money management strategy provides you with a wide range of benefits. It identifies the best-performing securities in comparison to others and, hence, helps you focus your investments on those that will likely yield greater returns. This, undoubtedly, is a cornerstone in any successful rules-based money management strategy.

## Incorporating Other Measures

While Relative Strength is a crucial part of a solid rules-based strategy, it’s important not to rely solely on one tool. Incorporating other measures into your strategy can give you a well-rounded picture of your investments and their potential performance.

1. **Risk Assessment**: Understanding the risks associated to your investments is crucial. In a rules-based approach, you’ll establish specific guidelines that define the level of risk you’re willing to accept. Tools such as Standard Deviation, Beta, and Value at Risk (VaR) can assist in this process, allowing you to decide which investments are within your risk tolerance.

2. **Diversification**: One golden rule in money management is to ‘never put all eggs in one basket’. Diversification is another key element to consider as it helps to reduce risk by spreading investments across different sectors, geographies, or asset classes.

3. **Asset Allocation**: This refers to the strategy of dividing your investment portfolio among various asset classes such as stocks, bonds and cash. The purpose of asset allocation is to reduce risk and create diversification by dividing assets among key categories.

4. **Indicator Levels