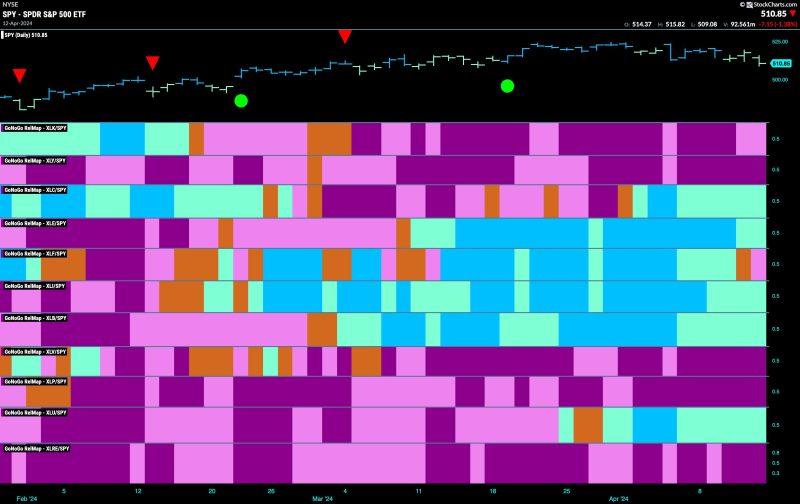

Facing Turbulence, Will Industrials Lead the Charge? Equity Market Trends in Focus – April 15, 2024

The global equity market has been witnessing a turbulent period as it struggles to hold onto the go trend. In light of recent developments, analysts have observed a new protagonist in the story – industrials. These key players have been attempting to lead the market amid fluctuating trends and uncertainties.

In the equity market, the term go trend signifies a bullish trend where the prices of shares are moving in an upward direction. However, maintaining such a positive trend consistently is a challenge due to various influencing factors like geopolitical tensions, corporate earnings, economic indicators, or unexpected events. The year 2024 has so far been no different, with the equity markets battling these factors to sustain the go trend.

The equity markets across the world have been striving to keep up with the constant flux. Yet, amidst all the struggles, industrials have emerged as potential leaders trying to steer the market towards stabilization. The critical role they are playing is worth elucidating on multiple fronts.

Firstly, industrials have a direct connection to the global economy’s health. They represent businesses involved in machinery, equipment, and supplies that are necessary for other sectors, including construction and manufacturing. Therefore, when industrials show strength, it tends to point towards a healthy economy, reflecting positively on equity markets.

Secondly, industrials have vast international exposure. They derive a significant chunk of their revenues from outside their home country, making them sensitive to global economic conditions. This international sensitivity means that industrials act as a barometer for gauging global economic health, which in turn influences investor sentiments in equity markets.

Among the industrials who are leading from the front, companies involved in sectors like aerospace and defense, machinery, and transportation have made significant strides. Their performance has kept investor enthusiasm alive, helping the equity market stay afloat amid the wavering go trend.

However, despite industrials’ efforts to hold the fort, challenges persist. Geopolitical tensions, trade restrictions, and supply chain disruptions due to unforeseen global events continue to test their resilience. A case in point being the ongoing tensions between major industrial powers that add uncertainty to the economic climate, and in turn, the equity markets.

Moreover, the changes in government policies and regulations have also been a significant cause of concern. The constant back-and-forth on policy revisions sometimes restricts the industrials’ growth, directly impacting their leading role in the equity market.

Lastly, one cannot rule out the influence of corporate earnings. Industrials,