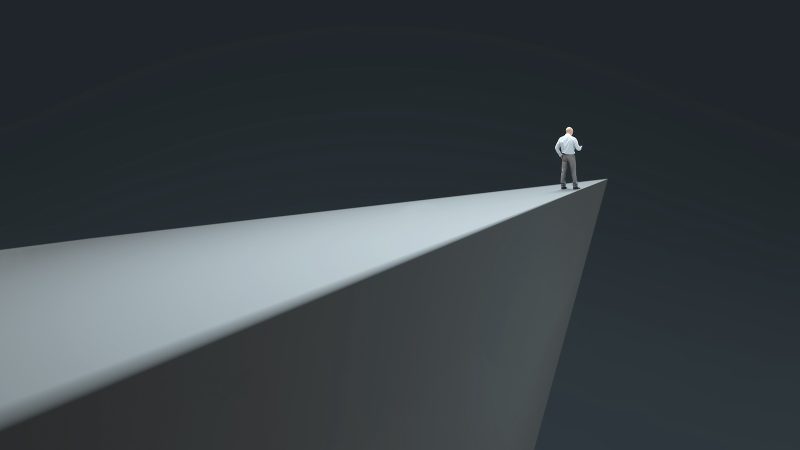

Crucial Checkpoints: QQQ’s Unsteady Course on Nasdaq’s Razor-Thin Line!

The Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100 Index, has recently been the subject of critical analysis among the investing community and market observers. This is due to the perceived precarious position it has been experiencing over the last few weeks, with the tech-heavy Nasdaq seemingly on the edge. Even though QQQ has proven its mettle as one of the most resilient exchange-traded funds (ETFs), a deeper dive into the current dynamics reveals essential levels every investor should keep an keen eye on.

One of the most fundamental considerations when examining QQQ is the top-heavy construction of the Nasdaq 100 Index. With significant holdings in big technology companies like Apple, Microsoft, Amazon, and Alphabet, the Index’s performance has major dependencies on the fortunes of these market-behemoth companies – influential spheres that QQQ cannot evade. If these big players show signs of sluggishness or suffer from market-wide plummets, the impact on QQQ is inevitable.

When examining the technical chart of QQQ, two significant price levels stand out. The first key level is the $350 mark, which has acted as a strong support level in recent times. Indeed, despite constant pulling and tugging by fluctuating market forces over the past few months, this ETF has managed to stay above this level, demonstrating an underlying tenacity in the face of market volatility.

However, the recent dip below this significant support level has led some market watchers to speculate about a possible pullback. If this were to occur, the next critical level to watch would be $340. The $340 price point has been tested multiple times and remains the last “wall of defense” for the QQQ before encountering a potential sharper fall, which could not only inflict massive damages to the QQQ but also send shockwaves across other markets as a significant psychological indication of a bear market.

On the flip side, we should also analyze an optimistic scenario. Bull market supporters point towards the $360 level which has acted as a strong resistance point historically. Surpassing this would mean a strong bullish continuation pattern, indicating the bears losing their control over the market and a high probability of a new upward trend.

In conclusion, the QQQ is at an interesting juncture. The next few trading sessions will undoubtedly be extremely crucial in setting the future trajectory of this ETF. As it teeters on the edge, the market will closely observe how it negotiates these critical price levels. Being mindful