Analysts Unlock the Mystery of Put/Call Ratios on Weird Wednesdays!

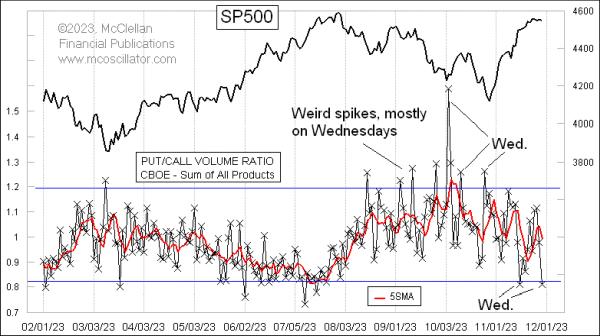

Weird Wednesdays. That’s a term that has become synonymous with the stock market. It’s the day where off-the-wall, odd occurrences, and situations can cause the Put-Call Ratio to completely derail from its normal levels. But what exactly is the Put-Call Ratio and how can it be impacted by what’s happening on Weird Wednesdays? Let’s take a look.

The Put-Call Ratio (often referred to as PCR) is simply a ratio between the number of purchase options (Put Options) on a security versus the number of sale options (Call options) on the same security. Generally, the Put-Call Ratio is an indicator to see if investors are bearish or bullish on a particular security.

When the Put-Call Ratio is higher than usual, it means that more people are purchasing Put Options, which implies that the market expects the stock to go downwards in the near future. On the other hand, when the Put-Call Ratio is lower than usual, it means that more people are purchasing Call Options, which implies that the market expects the stock to go up in the near future.

Weird Wednesdays can completely throw off the normal readings found in the Put-Call Ratio. It is on these days when large institutions may enter the markets and shift the reaction of the ratio to the opposite direction. This can be for any number of reasons, such as a corporate merger, a new product release, or even a large unstable news story.

These days tend to be characterized by heavier trading activity and sudden extreme swings in the markets. It’s important for investors to stay informed and aware of the news that is driving the markets and what the Put-Call Ratio could reveal about the direction a stock could be moving in.

In conclusion, the Put-Call Ratio is a helpful tool to measure bullish or bearish sentiment in the markets. Though it can be volatile, especially on Weird Wednesdays, it can be used in making investing decisions. It’s important to stay tuned into the latest news driving the markets for more insight into what the future may bring.